Application of the cumulative theory of prospectuses to identify the degree of risk solutions in the implementation of high-tech innovation projects

Abstract

This article is devoted to the peculiarities of the application of cumulative theory of prospectuses to identify the degree of risk decisions in the implementation of projects in the field of high-tech innovations. In the theoretical part of the article, the authors note that obtaining an assessment of the degree of efficiency of investments in various large innovative projects is a rather laborious and complex process, in which a special place should be given to the analysis of the risk of the investments themselves. As an effective way to assess the level of risk present in the implementation of innovative projects, the authors of the article study the cumulative theory of the prospectuses, based on the theories of utility and management decision making, created by Daniel Kaneman and Amos Tversky. Furthermore, the authors underline that if the administrative decision is accepted in the conditions of uncertainty, it should necessarily consider various psychological factors in comparison with classical models of decision-makin, which are constructed on conditions of the maximum availability of the information. In the research part of article, the authors consider a way of an estimation of integral risks of innovative projects. In the final part of article, the authors come to the conclusions that the algorithm of an estimation of risks of innovative projects should obligatory include, not only an expert estimation at an initial stage, but also the subsequent adjustment of the values received after the decision taken regarding the optimization problems.

keywords

application of cumulative prospectus theory, innovative high-tech projects, Kaneman-Tverski function, optimization methods, risk level analysis

Аннотация

Статья посвящена особенностям применениям кумулятивной теории проспектов для идентификации степени рисковых решений при реализации проектов в сфере высокотехнологичных инноваций. В теоретической части статьи авторы отмечают, что получение оценки степени эффективности инвестиций в различные крупные инновационные проекты является довольно трудоемким и сложным процессом, в котором особое место необходимо отвести анализу степени риска самих инвестиций. В качестве эффективного способа оценки уровня риска присутствующего при реализации инновационных проектов, авторы статьи рассматривают кумулятивную теорию проспектов, в основе которой лежат теории полезности и принятия управленческих решений, созданные Даниэлем Канеманом и Амосом Тверски. Авторы статьи подчеркивают, что если управленческое решение принимается в условиях неопределенности, то оно должно в обязательном порядке учитывать различные психологические факторы, в сравнении с классическими моделями принятия решений, которые построены на условиях максимальной доступности информации. В исследовательской части статьи авторы рассматривают способ оценки интегральных рисков инновационных проектов. В заключение статьи авторы приходят к выводам, что алгоритм оценки рисков инновационных проектов должен в обязательном порядке включать в себя, не только проведение экспертной оценки на начальном этапе, но и учитывать последующую корректировку значений, получаемых после решения оптимизационных задач.

Ключевые слова

анализ уровня риска, инновационные высокотехнологичные проекты, оптимизационные методы, применение кумулятивной теории проспектов, функция Канемана-Тверски

Introduction

Conducting a procedure to assess the efficiency of various types of investments in modern innovation projects is usually a rather complex task, which in the current economic realities can be successfully solved if it takes into account the direct investment risks. Innovation projects are highly exposed to risks that have a direct impact on investment performance throughout the innovation process, which is presented as a cycle. In the case of risk factors, there are significant losses in innovation efficiency: for example, the result of a group of risk factors in innovation, which may lead to the need for early termination of the project, even though the funds invested in its development are significant. Such factors could also include (Drogobytsky, 2018):

- the possibility of obtaining a number of negative results related to the product testing processes of an innovative nature;

- the impossibility to develop a set of project documentation within the established deadlines;

- the possibility of the appearance of hi-tech companies with more competitive products/services in the market.

If an innovation project is terminated prematurely, the enterprise can expect to receive only an insignificant amount of the value stipulated in the liquidation fund. Therefore, it may lead to a decrease in the capitalization indicators of the firm and significantly increase the probability of default. Therefore, the high-tech enterprise necessarily needs qualitative tools for quantitative assessment of risk of the possibility of termination of the activity of the innovative project. By using those tools, experts of the enterprise can make qualitative and effective decisions in the sphere of the organization and management of hi-tech projects in the sphere of innovations, taking into account possible risk factors. Conducting procedures for assessing the probability of occurrence of scenarios that are pessimistic in view of the high degree of novelty of projects in the field of innovation involve, on the one hand, the almost complete absence of any statistical data and, on the other hand, a very difficult task for specialists and managers of the enterprise (Rukinov, 2020).

Literature Review

Modern economic systems have a largely defined measure of sustainability. The concept of sustainability in relation to economic systems means that the latter have a certain ability that allows them not only to achieve certain results (which have a low degree of possible deviations), but also to use unique recovery mechanisms if the system is affected by negative factors. In complex political, social and economic conditions, the sustainability of economic systems directly depends on the extent to which their internal resources are used, as well as their ability to adapt to the constant changes taking place in the external environment (Sazonov, Mikhailova & Kolosova, 2017; Abdikeev, Bogachev & Bekulova, 2019). Consequently, any modern economic system has to be adaptive in nature, which will enable it to significantly reduce the current level of uncertainty inherent in the system itself, as well as making it sufficiently flexible to be able to respond quickly in the event of deviations from previously planned indicators. The simplest option for stability of almost any economic system is, of course, a state of equilibrium in which it can remain, for a sufficiently long period of time, provided that it is not affected in any way by any hard impact (Kiseleva & Begashev, 2014; Dmitriev & Novikov, 2019).

To date, several approaches have been identified to address the problems associated with determining the degree of risk present in the implementation of innovative projects, which in turn constitute the following groups (Kuntsman, 2018; Babkin, 2018):

- approaches aimed at establishing and then assessing the various objective probabilities of a possible termination of an innovation project;

- approaches needed to analyse and assess the various subjective probabilities of a possible termination of an innovation project.

When considering the approaches included in the structural composition of the first group, we can distinguish a category of approaches based on the bottom-up principle. In this case, we are talking about a procedure for assessing the probability of the implementation of certain risk factors, followed by a logical summation of individual probability values. It is also necessary to remember the use of the risk absorption rule, which is used to find an integral estimate of the probability of an unplanned termination of an innovation project (Dmitriev & Novikov, 2019; Isaychenkova, 2019). The approaches of the first group make it possible to create a detailed assessment of the level of risk, and analyze each individual factor, which in the end will allow the formation of an integrated risk assessment. It should be noted that when using the bottom-up approach, the probability that risk factors will not be fully considered is significantly increased. In turn, this can lead to an increase in the likelihood of underestimating the risk of a posible termination of an innovation project (Ananyin, Zimin, Lugachev, Gimranov & Skriprin, 2018; Novikov & Veas Iniesta, 2019). The other group is based on approaches to assessing risk-neutral probabilities of termination of innovative projects caused by the default of the project enterprise itself. At present, the following groups of methods are included in the structure of the main methods for assessing risk-neutral probabilities:

- valuation method based on analysis of market prices for bonds (state and corporate type);

- valuation method based on the analysis of changes in market prices for shares (ordinary, preferred and "golden" type).

The following assumptions are structurally based on risk-neutral approaches (Rakhimova, Kunanbaeva & Goncharenko, 2019):

- investors almost always take a neutral position on risk, i.e. we can say that investors are indifferent to the process of investing in various risk-free assets or in assets with a high probability of risk, with the same predicted return;

- as a rule, financial markets are highly effective instruments, that is, they almost instantly respond to various changes in information and immediately reflect this in the adjustment of prices for various types of financial assets, and it should also be noted that financial market participants are highly qualified and have the professional knowledge necessary for quick and high-quality processing of all incoming information;

- shares/bonds of the project company must have a high degree of liquidity, therefore, various types of trading operations must be performed on the stock market on a regular basis;

- changes in prices for various financial assets present on the market must necessarily be probabilistic in nature, and in no case depend on the behavior of each individual participant working in the market.

The assumptions discussed above indicate a significant limitation, and in the vast majority of cases, the inadmissibility of using risk-neutral approaches for assessing the likelihood of termination of an innovation project in an imperfect Russian market. The decision to implement an innovative project should be made considering many characteristics. Some of them are focused on the economic, environmental and social consequences of the project. The other part takes into account the various risks and uncertainties associated with the implementation of the project. The selection criteria for an innovative project are conditionally divided into the following groups (Romanova, Akberdina & Bukhvalov, 2016):

- target criteria;

- external and environmental criteria;

- criteria of the subject implementing the innovation project;

- criteria for a scientific and technical perspective;

- commercial criteria;

- production criteria;

- criteria for regional features of the project.

The criteria of each group are divided into mandatory and evaluative. Failure to meet the required criteria entails refusal to participate in the project. A group of approaches based on estimates obtained from the analysis of subjective probabilities of termination of innovative projects involves the active use of expert methods, as well as the application of the model of prospectus theory. Of course, the determination of the subjective probabilities of termination of projects based on the use of expert methods has rather significant drawbacks: for example, the results that were obtained during the examination of the assessment can have a very high level of dependence on the professional skills and knowledge of the expert himself. In the course of many years of work, Daniel Kahneman and Amos Tversky found that investors who are not risk averse, in the vast majority of cases, quite exaggerate the values of small probabilities (less than 0.2) and underestimate the average and values of large values ones. Therefore, this leads to the fact that in many cases, after the procedure of expert evaluations, the result was significantly distorted, which in turn gives one more reason for various manipulations and adjustments, under the result necessary for the enterprise management. As a result, innovative projects with a high degree of risk can easily go into the category of projects with a level that is quite acceptable for potential investors. The opposite situation is also possible, when innovative projects with rather low risk indicators and potentially high efficiency can be almost immediately rejected by the enterprise management, due to the fact that expert evaluations were overrated (Pinkovetskaia, Balynin & Berezina, 2019).

According to Amos Tversky, ideal optimization serves as a benchmark for orthodox proponents of rational choice. Despite this, they do not assume that decision makers do not always choose the option in an ideally optimal way. Decisions in life cannot be made without a factor of fallibility, but proponents of rational choice believe that it is difficult to predict these errors, or, according to a more conservative concept of rationality, it is generally impossible. Amos Tversky's work rejects such vision. He and his colleagues have shown that economic rationality is systematically violated, while decision-making errors are not only widespread, but also predictable (Skripkin, 2017).

Methodology

The theory of prospectuses created by Daniel Kahneman and Amos Tversky is based on the theory of utility and the theory of managerial decision-making. The prospectus theory makes it possible to efficiently solve the problem of analyzing and evaluating the selection process carried out by investors when choosing a potential investment object. The prospectus is an alternative to the selection process in which cash flows are uncertain. The prospectus also considers random losses and acquisitions received by the investor, and can also help establish some starting point from which possible losses and acquisitions can be calculated based on specially encoded information. The weighting model of the prospectus theory is calculated using the following formula (Kovalev & Konoreva, 2015):

where u(x) is the function to indicate the utility of money from a possible outcome x. Possible outcomes in this case may be the value of the cash flow currently expected under some scenario k of a possible project development in the field of innovation, which can be calculated based on the following formula (1);

![]() : outcomes that are negative, i.e. possible losses depending on probabilities

: outcomes that are negative, i.e. possible losses depending on probabilities ![]() ;

;

![]() : positive outcomes, i.e. possible acquisitions based on probabilities

: positive outcomes, i.e. possible acquisitions based on probabilities ![]() ;

;

m, n are the natural numbers, required to determine the number of the maximum negative and positive outcomes;

![]() are the "psychological" weights used in the weighting model, the main purpose of which is to take into account various distortions allowed by investors when assessing positive and negative outcomes.

are the "psychological" weights used in the weighting model, the main purpose of which is to take into account various distortions allowed by investors when assessing positive and negative outcomes.

In the course of experiments, Daniel Kaneman and Amos Tversky determined the following practical properties inherent to the weighing model (Figure 1):

- as a rule, the highest weight for investors with equal conditions is given to extremes, i.e. the best or the worst outcomes;

- the weight of a possible outcome is significantly affected by its position (rank), among other possible outcomes;

- investors quite strongly overestimate small outcomes (less than 0.2) and underestimate average and high probabilities (0.5).

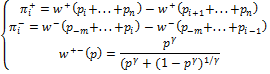

The above-mentioned practical properties of weight relate to a large extent to average investors who are not experts in the field of risk analysis and assessment. Daniel Kahneman and Amos Tversky determined the weights as follows (Kolosova, Sazonov & Vnuchkov, 2018):

(2)

(2)Figure 1. Graphic interpretation of Kaneman-Tversky function application.

The exponent w(p) is called the weight function. The parameter γ of the weight function has various values depending on the acquisition or loss. It must be remembered that the values of the parameter γ in the process of evaluating acquisitions are slightly lower than in assessing losses. Recommended values of the parameter γ are 0,6-0,7. Therefore, it is necessary to take into account the dependence of the sign in the upper index of the estimated area in the formula (2). The «+» sign is considered as an acquisition, and the «–» sign, respectively, as a loss of weight function. As a result, for outcomes characterized by minimum and maximum indicators, we have:

Method for assessing the integral risks of innovative projects

Let us consider the question of determining the value of the risk indicator using the apparatus of fuzzy sets. A fuzzy set![]() is the membership function of the elements of the fuzzy set A:

is the membership function of the elements of the fuzzy set A: ![]() . Here

. Here ![]() is is a universal set, a collection of elements of some kind. For each element

is is a universal set, a collection of elements of some kind. For each element ![]() the membership function determines the degree of its membership in that set of elements that is formalized by a given fuzzy set. A mathematically fuzzy set is defined as follows:

the membership function determines the degree of its membership in that set of elements that is formalized by a given fuzzy set. A mathematically fuzzy set is defined as follows:

We assume that the risk indicator ![]() is calculated for a specific set of project parameters, taking into account all factors affecting this risk, i.e. the risk indicator is considered as a function of many variables

is calculated for a specific set of project parameters, taking into account all factors affecting this risk, i.e. the risk indicator is considered as a function of many variables ![]() where, for example (Astapov, 2015):

where, for example (Astapov, 2015):

is the unit cost of production;

is the unit cost of production; is the unit price;

is the unit price; is the sales volume, etc.

is the sales volume, etc.

In this case, if the index is calculated for the first parameter, then ![]() is a function of the following factors:

is a function of the following factors:

is the decline in production (interruptions in the supply of raw materials, materials, components, marriage due to the fault of workers, marriage due to equipment failure, obtaining poor quality raw materials, materials, components, accidents, natural disasters);

is the decline in production (interruptions in the supply of raw materials, materials, components, marriage due to the fault of workers, marriage due to equipment failure, obtaining poor quality raw materials, materials, components, accidents, natural disasters); is the production growth;

is the production growth; is the change in prices for raw materials, components;

is the change in prices for raw materials, components; is the change in price of labor force;

is the change in price of labor force; is the change in prices for services of third parties in packing, storage, transportation, sales, etc.;

is the change in prices for services of third parties in packing, storage, transportation, sales, etc.; is the change in taxes;

is the change in taxes; is the occurrence of inflation or deflationary processes;

is the occurrence of inflation or deflationary processes; is the lack of working capital, which causes loan taking and interest payment;

is the lack of working capital, which causes loan taking and interest payment; is the payment of fines, penalties and forfeits.

is the payment of fines, penalties and forfeits.

As a rule, the approach of expert clarification of the risk indicator is practiced focusing on the factors influencing it. For the sake of certainty, let us assume that the risk indicator is calculated considering a certain number of factors affecting it:

where ![]() is a fixed, planned unit cost of production without risk factors;

is a fixed, planned unit cost of production without risk factors;

![]() is a refined unit cost indicator.

is a refined unit cost indicator.

Results

The development of innovation is one of the ways to overcome the consequences of the global economic crisis, both at the national and regional levels. Therefore, scientific research aimed at developing effective methods and means of managing innovative processes are of high practical importance and contribute to the development of the theory and practice of innovation management. The formation of an open expandable information infrastructure for scientific and innovative activities, coupled with the development of methods and technologies for its information and analytical support, largely determine its effectiveness, both within individual territories and in the country as a whole. When assessing the risks of an investment project, it is necessary to take into account the uniqueness of each project, which requires a search for completely new solutions, various applications and a combination of several tools and assessment methods for the effective implementation of the project. In the work, an analysis of the main approach used to determine the likelihood of termination of projects in the field of high-tech innovation was carried out. According to the results of the analysis, the following features of the implementation of the theory of prospectuses were identified:

- application of the “top-down” approach does not increase the degree of probability of taking into account risk factors, which can lead to an incorrect / inaccurate assessment of the risks of termination of projects in the field of innovation;

- approaches based on risk-neutral estimates, as a rule, depend on changes in market prices for various financial instruments. It should be kept in mind that the structural basis of such approaches is based on the principles of an investor's neutral attitude to risks, as well as the significant role of trade in the work of various financial instruments. Therefore, these factors indicate a certain degree of limited risk-neutral approaches when assessing the possible termination of projects in the field of innovation;

- when using expert approaches in practice, it must be remembered that they largely depend on the competencies of the experts themselves. Practical experiments conducted by Daniel Kahneman and Amos Tversky have unambiguously shown that the minds of experts quite strongly exaggerate the values of small probabilities and downplay the values of large and medium probabilities to the same extent.

Conclusions

Innovative projects and processes at all stages are characterized by the absence of a full guarantee of achieving a successful result. The development of innovation in recent years shows that the practice of applying many investment approaches is unpromising. Therefore, in addition to risk assessment, building forecasts and other approaches that are gradually entering into everyday activities when evaluating innovative projects, their support should appear at all stages of the life cycle, which is justified by significant risks of the innovation process. To assess the risk in the implementation of various innovative projects, it is proposed to use the following algorithm:

- get an initial expert assessment, which will include various probabilistic scenarios of a future innovation project;

- determine the weight function, establish its values and make a subsequent assessment, i.e. compose and solve systems of nonlinear equations;

- carry out a final adjustment of the obtained probability values.